child tax credit 2022 income limit

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. To receive the maximum credit your household income must be below 200000 or 400000 for married.

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

According to Pennsylvanias official.

. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Married couples filing a joint return with income of 400000 or less. If you earn more than this.

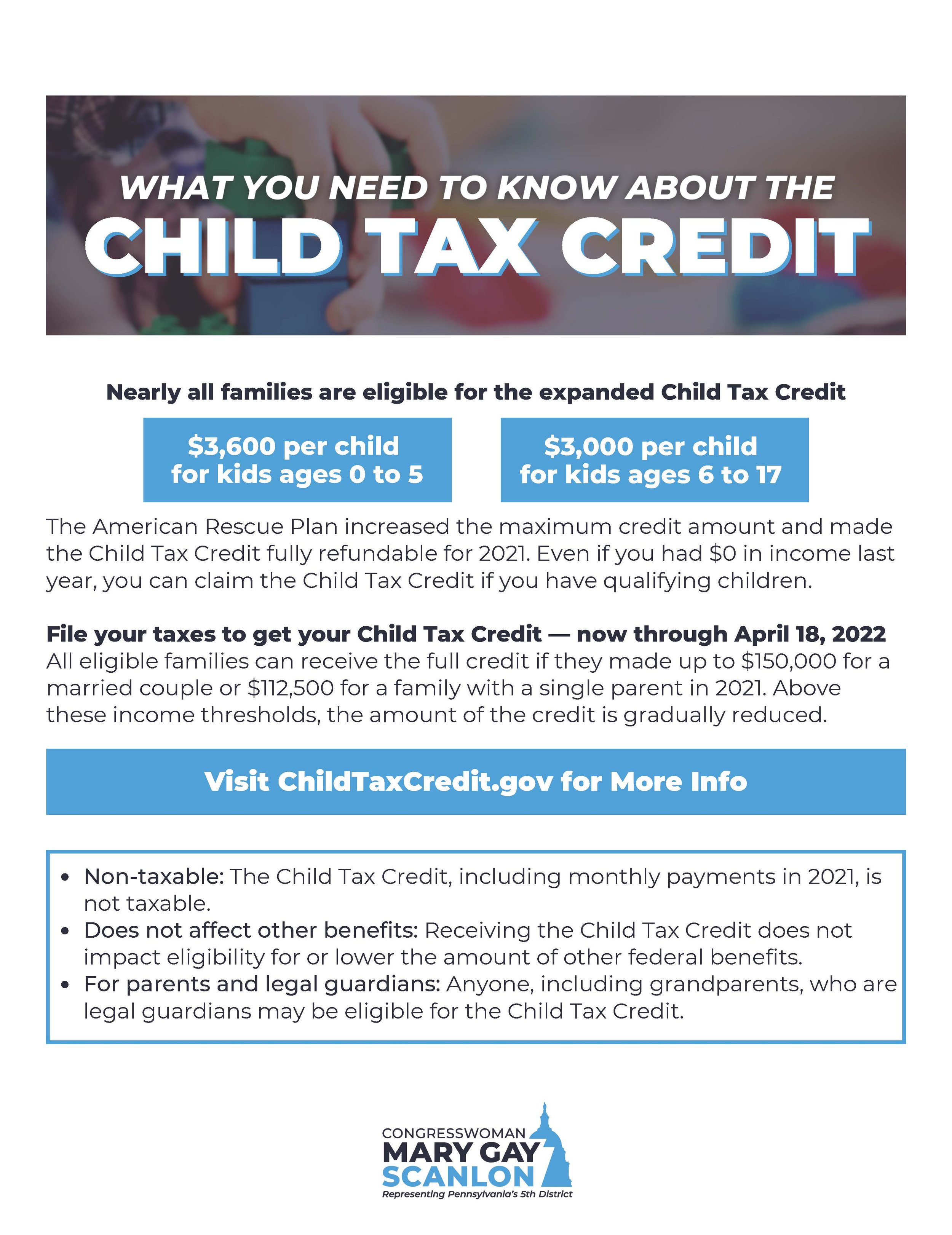

The maximum annual Child Tax Credit rates are shown below. This means that next year in 2022 the child tax credit amount will return to pre-2021 levels that is up to 1800 per child for children under six years of age and up to 1500. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a.

Income Limits The amount of the credit that you receive is based on your adjusted gross income. What Families Need to Know about the CTC in 2022 CLASP. The income limit was 68960 and for a household of four it was 104800 Alaska and Hawaii.

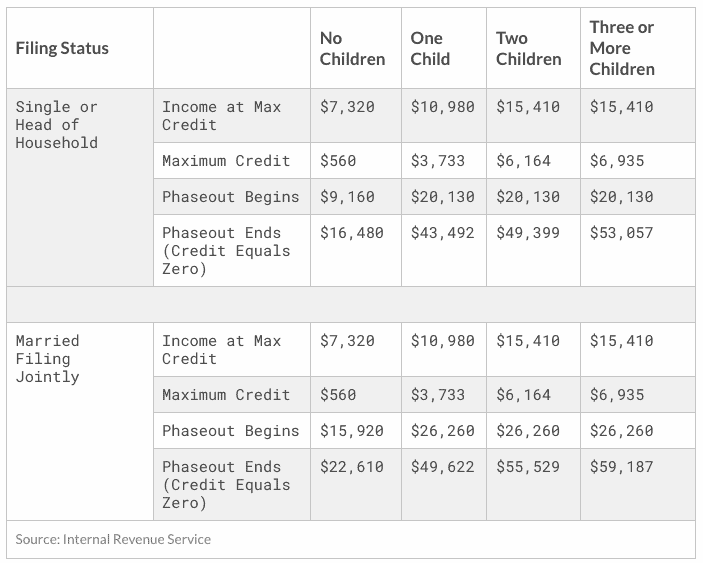

2022 Tax Brackets Mark Kantrowitz The Kiddie Tax thresholds are increased to 1150 and 2300. Rates per year 2022 to 2023. The Child Tax Credit CTC is a partially-refundable tax credit available to parents with qualifying dependents under the age of 17.

Child Tax Credit family element. For children under 6 the CTC is 3600 with 300 optional monthly. This is up from 16480 in 2021-22.

Ad Access IRS Tax Forms. The child tax credit can be worth up to 2000 per child under 17. 200000 for single filers and 400000 for those married filing jointly to receive the normal 2000 child tax credit.

Child and Dependent Care Tax Credit Expense limit. The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to. Federal Filing Completely Free.

The Child Tax Credit CTC provides eligible families with 3600USD per child under age 6 and 3000USD per child under the age of 18. The maximum amount of child and dependent care expenses. Single Head of Household or Qualifying Widow er.

To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year. Age and Income Limits Differ Across Credits. These FAQs were released to the public in Fact Sheet 2022-28PDF April 27.

However there is a child tax credit 2022 income limit on who qualifies for the child tax credit and how much they. The child tax credit has been increased from 2000 to 3000 or 36000 depending on the age of the qualifying child. The refundable portion of the Child Tax Credit has increased to 1500.

Frequently asked questions about the Tax Year 2021Filing Season 2022 Child Tax Credit. The maximum credit amount ranges from 300 to 1200 depending on the number of qualifying. Thats because the child tax credit is dropping to 2000 for the year.

Families are Eligible for Remaining Child Tax Credit Payments in 2022 IRS Free File available to people whose income was. Ad Claim the Child Tax Credit on Your 2021 Return with FreeTaxUSA. Below is the current phase-out amounts.

The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000. Families with a single parent also. The child tax credit can be worth up to 2000 per child under 17.

Here are 9 things to know for 2022 about changes to your 401K child tax credit Social Security. The credit amount varies depending on the number of qualifying children and income level. 200000 for single.

However there is a child tax credit 2022 income limit on who qualifies for the child tax credit and how much they are. These people qualify for a 2021 Child Tax Credit of at least 2000 per qualifying child. Complete Edit or Print Tax Forms Instantly.

The child tax credit CTC will return to at 2000 per child in 2022. Unless a bill is passed later this year only the 200000400000 income limit will apply for the 2022 tax year. See what makes us different.

The Child Tax Credit is worth up to 2000 per qualifying child. The amount of expenses used to calculate the 2021 credit was increased. This means that the maximum total amount of the credit is 4000 50 percent of 8000 if you have one qualifying person and 8000 50 percent of.

75000 for single filers 112500 for heads of household and. We dont make judgments or prescribe specific policies.

What Is The Child Tax Credit Tax Policy Center

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

White House Unveils Updated Child Tax Credit Portal For Eligible Families

Child Care Tax Credit Is Bigger This Year How To Claim Up To 16 000 Cnet

Child Tax Credit Here S What To Know For 2022 Bankrate

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

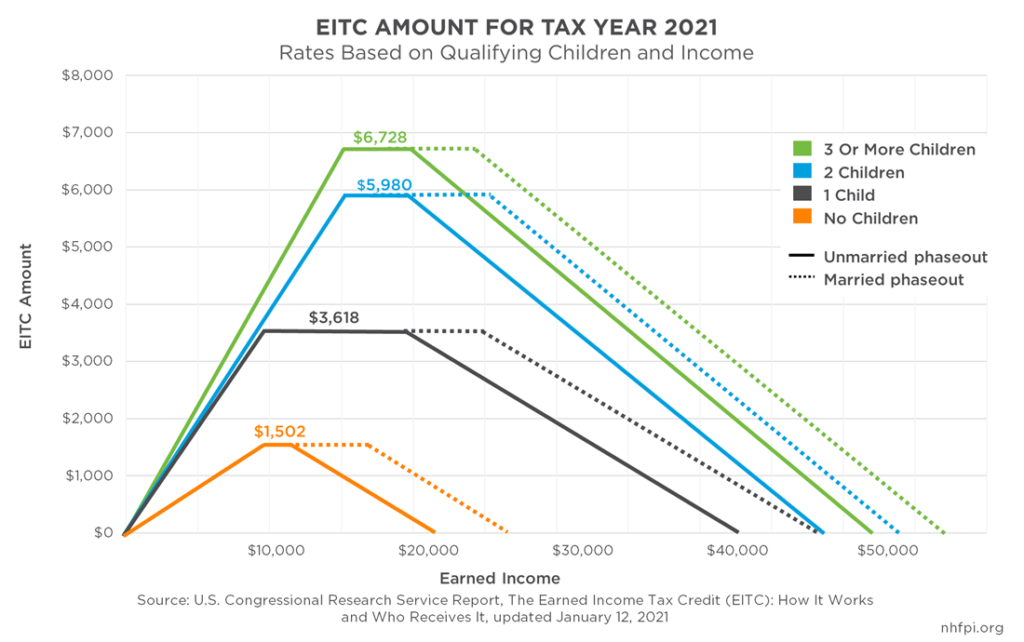

Expansions Of The Earned Income Tax Credit And Child Tax Credit In New Hampshire New Hampshire Fiscal Policy Institute

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

2 000 Child Tax Credit 2022 Who Is Eligible For Payment As Usa

Why Opting Out Of Monthly Child Tax Credit Payments May Work For Some Families Boyer Ritter Llc

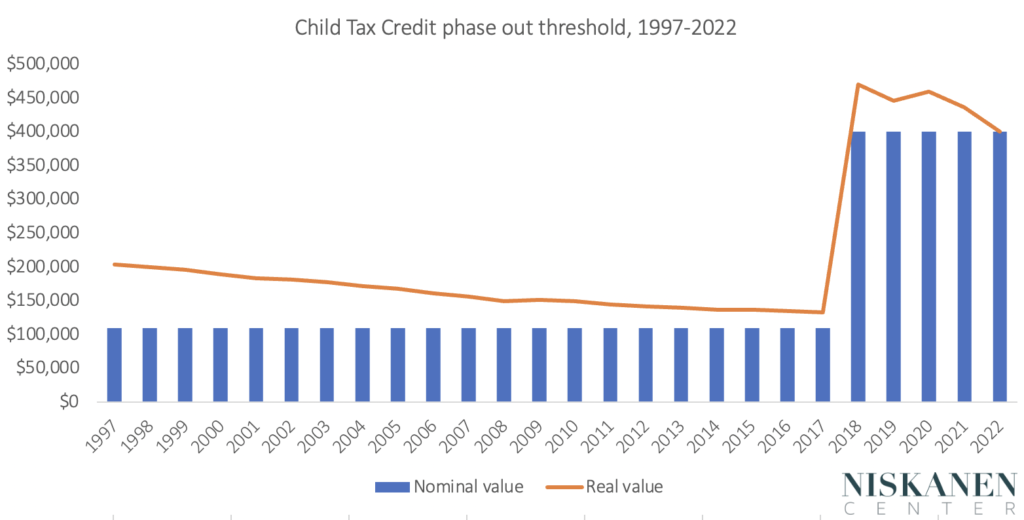

Indexing The Child Tax Credit Is Long Overdue Niskanen Center

Opinion Robert E Rubin And Jacob J Lew A Plan To Help Kids Without Increasing Inflation The New York Times

What Build Back Better Means For Families In Every State Third Way

What Families Need To Know About The Ctc In 2022 Clasp

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Child Tax Credit File Your 2021 Taxes Even If You Had 0 In Income Local Resources For Tax Help For Low Income Families Legal Aid Of Southeastern Pennsylvania

If Congress Fails To Act Monthly Child Tax Credit Payments Will Stop Child Poverty Reductions Will Be Lost Center On Budget And Policy Priorities

Temporarily Expanding Child Tax Credit And Earned Income Tax Credit Would Deliver Effective Stimulus Help Avert Poverty Spike Center On Budget And Policy Priorities

What To Know About The New Monthly Child Tax Credit Payments